- Alışveriş sepetinizde hiç ürün yok

- Ara toplam: ₺0.00

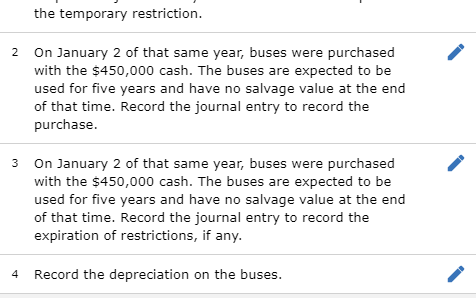

2.2.step one. Tv Credit will send a pleasant Letter setting out brand new pre-acknowledged mortgage plan/ credit info plus the gist away from very important conditions and terms relevant for usage of one’s borrowing facility through the given get in touch with settings/info

2.2.2. Abreast of bill of one’s Acceptance Page, the newest Borrower can also be turn on new pre-accepted loan program business courtesy Television Credit Saathi application (Saathi App) (or) because of Television Credit’s site available during the (Tv Borrowing from the bank Site) (or) by the increasing a demand during the Tv Credit’s support service contact number.

dos.2.step three. As Debtor receives an Texts / e-post end up in out of Tvs Borrowing verifying profitable enrolment toward pre-accepted mortgage program and you may sanctioning away from a credit limit to help you their/her entered cellular count / e-mail id, since instance perhaps, the fresh Borrower shall sign on toward Saathi Software/ Tvs Borrowing Website / IVR using inserted cellular number and stimulate the newest Pre-acknowledged mortgage program studio locate his Pre-acknowledged loan typing their big date away from birth & OTP delivered to his entered cellular count.

dos.2.4. Article effectively offering the history, the latest Borrower will receive Preapproved mortgage plan business activation confirmation through Texting /e-post to help you his entered mobile count / e-post id, once the instance maybe.

Almost every other Terms and conditions

3.step 1. The fresh Borrower believes you to any business / deal under so it Preapproved loan program is going to be considered as a great separate mortgage studio and the terms and conditions of the Master Financing Agreement performed/ as carried out from the Debtor would be joining and you will appropriate.

step three.2. The newest eligibility out of credit limit, professionals, also offers / other most properties considering beneath the pre-acknowledged financing programme might be within best discernment regarding Tv Borrowing.

step three.step 3. The newest Borrower shall put the demand each and every time to make use of brand new Borrowing from the bank business away from Tvs Credit (and this will likely be at the mercy of new terms of the owner Loan Agreement), prior to making one transactions within the pre-recognized mortgage programme.

step 3.4. The credit studio would be good for usage only within the India and also for the acquisition of items or properties into the Indian currency merely. And, truth be told there might be constraints on the use from the certain seller cities / establishments/ category sometimes permanently otherwise just like the could be communicated away from time and energy to day.

step three.5. The new Debtor constantly undertakes to act during the good-faith within the family to transactions to your pre-accepted loan programme and Tvs Credit.

step three.6. The Borrower believes your mortgage business in pre-accepted loan program is not intended to be employed for pick out-of banned issues within the relevant rules from India for example lottery passes, blocked otherwise proscribed magazines, contribution within the sweepstakes, fee having telephone call-right back characteristics, etcetera., or deals dominated in fx.

3.seven. Television Borrowing from the bank should not be guilty of one downfalls otherwise errors or malfunctioning out-of POS otherwise program otherwise terminal throughout the procedures otherwise digital investigation simply take.

3.8. In the event of any breach of these terms and conditions by Borrower, he/she shall be accountable for people losings, personally otherwise ultimately, as a consequence of such as for instance a violation; and you can prone to spend Television Credit, up on demand. New standard if any committed from the Debtor according off his/their particular borrowing business availed out of Television Borrowing from the bank will create infraction.

The Borrower will likely be limited by these types of Terms and conditions & Requirements and you will procedures stipulated by the Television Credit, periodically, in connection with this

step three.9. In the eventuality of one personal loan company Oasis UT conflict otherwise disagreement ranging from Television Borrowing from the bank in addition to Debtor about your materiality of every matter and additionally people experiences, density, condition, alter, facts, pointers, file, consent, continuing, work, omission, states, breach, default otherwise including fool around with otherwise misuse of Pre-accepted mortgage plan facility, brand new view out-of Tv Borrowing from the bank to what materiality of any of the foregoing shall be final and you will joining towards Borrower.