- Alışveriş sepetinizde hiç ürün yok

- Ara toplam: ₺0.00

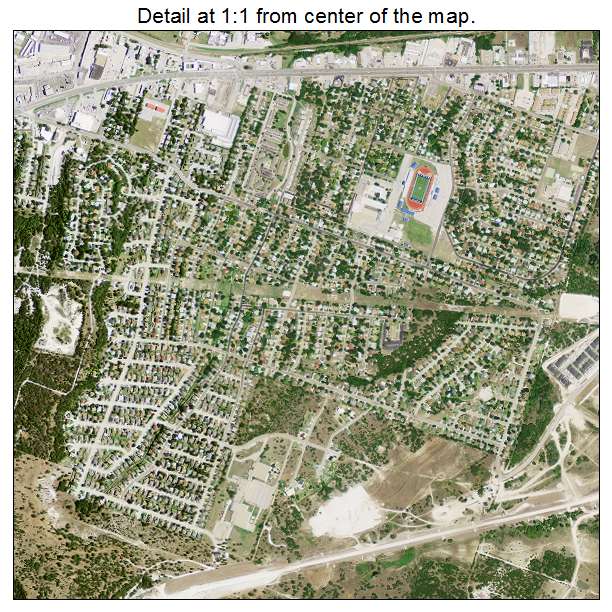

As a high step one% Creator in the united kingdom, Joel are a dependable Dallas lending company. The guy knows the need for responsive and you can educated service, particularly in a quickly growing location town such as for example Dallas-Fort Really worth. This new previous Us Census Bureau statement possess Fort Well worth ranked due to the fact quickest-expanding city in america. And you can Webpages Choice Category contains the Dallas Metroplex once the fifth fastest-broadening urban area town in the country of the 2028!

Relocations always keep raining from inside the, that is resulting in a low source of virginia homes. As a result, home values is up. If you’re an initial-time homebuyer, this particular fact may sound overwhelming. However, if you can buy a house, you should continue to pick a house. Joel Richardson is here to help you get a mortgage order your dream household today.

Home loan Credit Produced Troubles-free to have People from inside the Dallas, https://cashadvancecompass.com/payday-loans-oh/ Tx

Whether or not you purchase a property the very first time or is a well-versed homebuyer, you need to know you to definitely to acquire a home was fascinating and you can rewarding. In Dallas and you can Fort Worth, you will find some loan possibilities that can be used depending on your position.

Antique, Repaired Rates Home loan

The rate will not alter in the lifetime of the newest mortgage. For some home buyers, the minimum down-payment is step 3%.

Federal Houses Management

A federal government-covered mortgage for these that have limited income otherwise dollars to have a deposit. FHA funds likewise have fixed costs and lowest down-payment try step three.5%.

Experts Issues Financial

Advantages previous and you may energetic armed forces employees and their group. Virtual assistant finance is actually fixed price funds and provide $0 deposit alternatives.

Arm Financing

Adjustable rate mortgage otherwise Sleeve where in actuality the payment per month is restricted for some many years following will adjust then fixed rate several months. Minimal downpayment was 5%.

USDA Financial

Us Company from Agriculture (USDA) mortgage, which is also a federal government-supported loan for many who live in faster towns and cities and you can places. USDA offers $0 down payment it is money minimal.

JUMBO Money

Also known as nonconforming money since loan amount is actually high as compared to controlled restrictions having conventional funds. Predict 10% down at the very least together with most useful rates wanted 20% off. Both fixed and you may variable rate finance are available for jumbo circumstances.

Dallas Mortgage brokers Generated Troubles-100 % free

You are searching for a mortgage credit choice inside Dallas given that need let to acquire a house. At the same time, you would like the method as because troubles-free that you could. The financial institution will likely be some body you trust. We understand financial support your ideal is a big deal, therefore you should find the appropriate mortgage lender in the Dallas, Colorado. Luckily for us, you’ve got arrive at the right place. Joel Richardson as well as the VeraBank people is right here to make sure your feel at ease from inside the process.

We all know that rates provides a critical impact on their choice. Meanwhile, we ensure that the procedure is effortless, fast, and you may worthy of your time. Here is how it functions:

Step one

Start by the application processes. It isn’t difficult! Your apply on the internet and it takes merely a couple of minutes. Brand new a number of simple-to-know issues commonly lead you with each other. You could choose a cost and will including select the fresh new deposit. Once pre-qualifying, we are going to give you that loan imagine.

Step two

From my personal site, you could upload documents that individuals require so you can meet the requirements you. Attempt to fill in essential files ahead of i just do it for the order to manufacture a prequalification letter.

Step three

Whenever we is issue the fresh new prequalification, you are on our home seem! Their real estate agent will need the prequalification* page to provide an offer on the provider. We works hand-in-give together with your agent presenting your own provide to your vendor. (*An excellent prequalification isnt an affirmation from credit, and won’t signify one underwriting conditions were met. )