- Alışveriş sepetinizde hiç ürün yok

- Ara toplam: ₺0.00

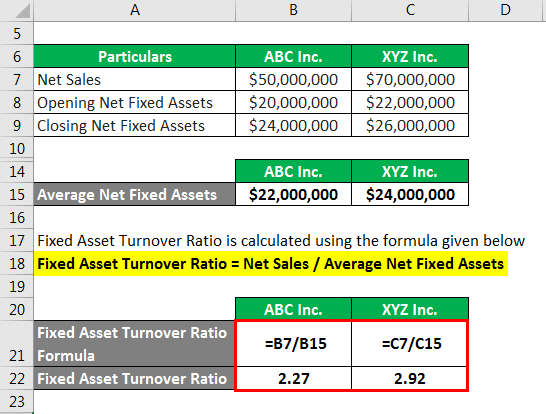

Understanding asset turnover ratios is an important part of business management. It’s a measure that tells you how well your company uses its assets to generate revenue. the asset turnover ratio is calculated as net sales divided by A more complicated version of asset turnover is “fixed asset turnover”. This only counts the average dollar amount of fixed assets used each year to generate revenue.

What’s considered a good times interest earned ratio?

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. For Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 PP&E balances ($85m and $90m), which comes out to a ratio of 3.4x.

How is the times interest earned ratio calculated?

The value of a company’s total assets includes the value of its fixed assets, current assets, accounts receivable, and liquid assets (cash). The total asset turnover is defined as the amount of revenue a company can generate per unit asset. Mathematically, it can be understood as revenue over the average total assets.

What Does Asset Turnover Ratio Measure?

You can use our revenue Calculator and efficiency calculator to understand more on these topics. The fixed asset turnover ratio does not incorporate any company expenses. Therefore, the ratio fails to tell analysts whether a company is profitable. A company may have record sales and efficiently use fixed assets but have high levels of variable, administrative, or other expenses.

Using the Asset Turnover Ratio With DuPont Analysis

It can be used to compare how a company is performing compared to its competitors, the rest of the industry, or its past performance. The times interest earned ratio measures a company’s ability to make interest payments on all debt obligations. The times interest earned ratio (TIE) measures a company’s ability to make interest payments on all debt obligations. You can compare your company’s current asset turnover ratio with others in the same industry to see how you stack up.

- This variation isolates how efficiently a company is using its capital expenditures, machinery, and heavy equipment to generate revenue.

- Meredith is frequently sought out for her expertise in small business lending and financial management.

- Yes, excessively high asset turnover may indicate that a company is too aggressive in managing its assets, potentially sacrificing long-term growth or quality for short-term gains.

- Therefore, internal maintenance management must focus on cost control, efficient work scheduling, and confirming adherence to regulations.

What’s the difference between total assets and average total assets?

The asset turnover ratio helps investors understand how effectively companies are using their assets to generate sales. Investors use this ratio to compare similar companies in the same sector or group to determine who’s getting the most out of their assets. The asset turnover ratio is calculated by dividing net sales or revenue by the average total assets. The asset turnover ratio measures the efficiency of a company’s assets in generating revenue or sales. It compares the dollar amount of sales to its total assets as an annualized percentage. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets.

This gives investors and creditors an idea of how a company is managed and uses its assets to produce products and sales. Depreciation is the allocation of the cost of a fixed asset, which is expensed each year throughout the asset’s useful life. Typically, a higher fixed asset turnover ratio indicates that a company has more effectively utilized its investment in fixed assets to generate revenue. The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets. The asset turnover ratio indicates the efficiency with which a company is using its assets to generate revenue. The fixed asset turnover ratio formula divides a company’s net sales by the value of its average fixed assets.

This is a rare scenario and typically indicates serious operational issues or accounting errors. Generally, a higher ratio is better, indicating that a company efficiently utilizes its assets to generate revenue. However, what constitutes a “good” ratio depends on factors like industry norms, company size, and specific business strategies.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.