- Alışveriş sepetinizde hiç ürün yok

- Ara toplam: ₺0.00

Let’s say you have a credit card balance, car finance, and possibly your have even beginner financial obligation. This means that, you borrowed from money. Let’s in addition to state, you’ve decided that the most readily useful method is so you’re able to consolidate your debt to possess a lesser price and you will solitary fee, very you are searching for financing enabling one to would very. You can find choices!

A classic debt consolidation mortgage most definitely will build dealing with your own finances simpler and may also help you reduce the total notice your will pay, but could in addition, it feeling your odds of taking home financing?

To determine people disadvantage, for anyone looking to each other combine personal debt and you can funds a house, look at the adopting the affairs.

Whenever Must i rating a debt negotiation Financing?

To determine although a debt settlement loan is useful to you personally there are two main trick bits you must know; the phrase of one’s loans while the rate of interest of your own obligations.

Term

Debt consolidation reduction loans would be best used if you have a lot of time otherwise open-finished label debt with a high interest rates because of the characteristics off the way they was structured. Consolidation money will have apparently quick, given terminology-typically between you to definitely 7 age. This means that you could repay balance prior to when your carry out with financing featuring prolonged terminology otherwise revolving particular obligations, bad credit installment loans Rhode Island particularly playing cards.

Price

Individuals also can make use of lower interest rates when taking away a debt settlement mortgage. This is also true to own credit debt. Particularly, the average bank card interest rate was 14.7% in early 2021. At the same time, you will get taken out a debt consolidation loan having an enthusiastic mediocre interest from nine.46%.

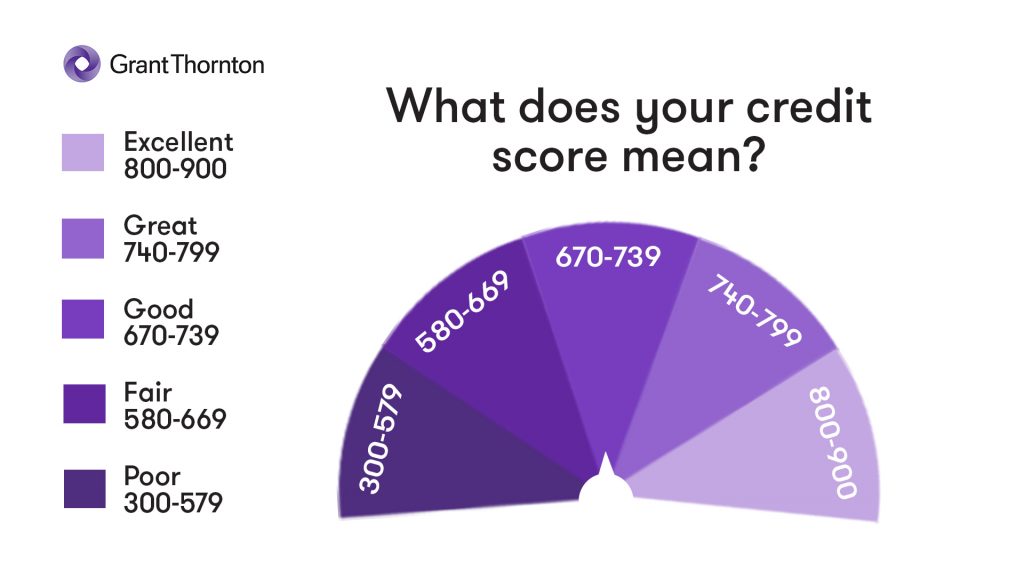

Inside circumstance, the mixture off identity and you will rate with the an integration financing carry out allow you to pay off your own personal credit card debt less and you may at a lesser rate of interest, definition you’ll spend shorter out of pocket along side life of the borrowed funds. Simply just remember that , the speed you’ll get would depend through to a few products, such as credit score along with your personal financial situation.

Usually a debt negotiation Mortgage Impression My personal Capacity to Score an excellent Mortgage?

Typically, which have a debt consolidation loan will not have a bad effect on your power to re-finance your home otherwise receive a unique mortgage. Actually, it could actually alter your ability to be considered.

Something that a lender tend to determine inside financial or refinancing comment is your obligations-to-income ratio. You can calculate this essential formula by the breaking up the complete from their monthly costs by your pre-taxation monthly income.

Such, if one makes $cuatro,000 thirty day period and you may pay $step 1,100 into the lease, $100 on the credit card debt and another $600 thirty days into the an automobile fee, your debt-to-income ratio try forty five%, a number of facts over the 35% so you’re able to 40% that all mortgage brokers like to see.

Merging the debt might just have a confident effect on their debt-to-earnings proportion by eliminating the level of the payment. Including, for people who move your own car finance and you may mastercard balances for the a good consolidated financing on a diminished rate of interest, along with your monthly installments try shorter so you can $450, you could lower your the newest ratio in order to a time the place you would quicker qualify for home loan investment.

Could it be a smart idea to Combine Loans on home financing?

It is extremely common to own people to combine debt, along with handmade cards, car and you can student loans to their mortgage. As the interest rates to possess mortgages shall be less than other styles away from personal debt, instance handmade cards, you could potentially reduce the full focus you pay having a home loan financing while the you may be generally utilizing your house given that security.

Rolling all expenses to your home financing then makes it you are able to to merge your financial financial obligation to your one payment in the a lower life expectancy interest, and thus cutting your total monthly aside-of-pouch expenses. Which improves your money circulate and may also have the ability on how best to a whole lot more aggressively spend less.

Yet not, there was a disadvantage. Once the typical name to possess a consolidated mortgage can be zero over seven decades, home financing identity constantly covers a fifteen- to 31-season schedule. That implies, you will be spending thereon debt while you’re using the borrowed funds on the family.

Seek advice and you may Advice Before you can Operate

Since you need to evaluate these activities, and a lot more, it is essential to sit down and you will correspond with a mortgage lender prior to making your future circulate. That loan officer commonly ask you questions about your small- and you can enough time-term financial requires and your present disease immediately after which, provide you with alternatives in order to build informed conclusion.

Understand that debt well-in the long term will be based upon the choices you will be making today! No matter your current condition, you may make advancements. Selecting the suggestions out-of leading masters is an excellent step of progress to your roadway.