- Alışveriş sepetinizde hiç ürün yok

- Ara toplam: ₺0.00

A home loan recast , occurs when a loan provider recalculates the monthly premiums on the most recent financing in line with the a great harmony and you will kept label.

When you buy a property, your bank works out their home loan repayments in line with the prominent balance as well as the mortgage label. Every time you generate a cost, what you owe decreases. But what happens if you make an extra percentage otherwise pay a tad bit more per month? Or create a lump-contribution payment? When you’ve repaid extra principal numbers just before schedule, it may seem sensible so you can demand home financing recast. Since the a great recast lies in the rest balance of loan and amazing identity, your monthly payment you will fall off.

Recast versus refinance

Once you re-finance your house , you fill out an application to produce a new loan that have an effective different interest rate and other title, or to take-out guarantee.

With a home loan recast, the one and only thing you are doing is actually recalculating your own payment. An effective recast does not affect your interest rate, kept loan term or security.

Mortgage recasts are a great choice for home owners who would like to get rid of the payment per month instead of changing the fresh new regards to the financing. A few of the instances when a home loan recast could be an excellent good idea include:

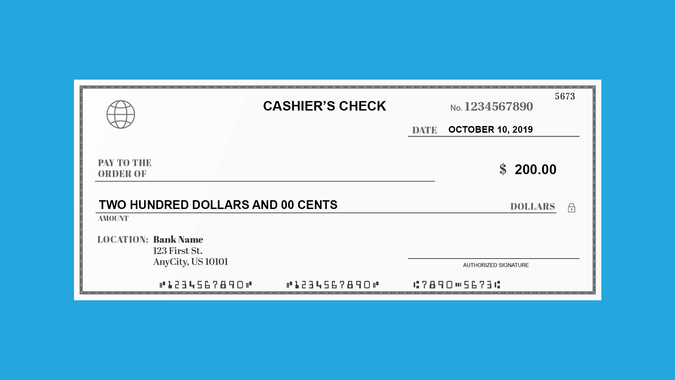

- You obtained an enormous windfall. For folks who found a massive bucks percentage, such as a bonus or heredity, thereby applying a giant portion of it towards your mortgage principal, you are able to slow down the count you owe. Their monthly installments will be based off of personal loans for bad credit Virginia the the financing equilibrium when you do a beneficial recast.

- Mortgage cost have raised. In many cases, individuals check out all the way down its payment per month however, can’t because mortgage rates have remaining right up because they signed on their financing. In cases like this, it generally does not seem sensible so you can re-finance. Rather, if you’ve reduced your balance and now have guarantee on your own domestic, you can keep your current interest and you can recast to regulate your own payment per month number.

- You happen to be moving. After you sell that house to purchase a separate, you can make use of the guarantee in the sales towards your the fresh financial. Exactly what goes if your dated household doesn’t close before you sign up your that? Home financing recast makes it possible to decrease your the latest home loan repayments after the product sales on your dated home closes. Once you receive the money from the new sales of your house, you can make a swelling-share payment and have their lender to help you recast your loan.

The many benefits of a home loan recast

- No credit check called for. When you refinance that loan, your own bank discusses your credit history and changes their words based on your creditworthiness. There can be basically no credit check that have a great recast.

- Less of your budget repaid towards the appeal. Once you lower your principal, your overall interest decreases over the longevity of the loan. It, subsequently, minimizes simply how much you pay to suit your financing full.

- Keep your latest interest rate. That have home financing recast, regardless of what the present day financial costs is actually. Even when the costs went up, it is possible to maintain your all the way down speed.

- No closing costs. After you refinance the loan, you’ll have to shell out closing costs. Their financial can charge a fee in order to recast your loan, but it is usually below antique closing costs.

- You never offer the remaining term of the financing. Once you re-finance financing, you might have to boost your loan title. With a recast, the size of the loan will not change.

- No very long app procedure. Refinancing property pertains to most of the exact same techniques while the your completely new mortgage app. That have a mortgage recast, you will find hardly any requisite therefore the procedure is a lot reduced.